In the last couple of days, X and other crypto social media is flooded with screenshots of the “Fear & Greed Index” printing “Extreme Fear”, usually with a Warren Buffet quote, or something similar.

Let’s dig into whether it really has any predictive power at all!

What is it, at all?

So the original Fear & Greed Index is meant to be a composite indicator, made by Alternative.me, with all the different factors that are included:

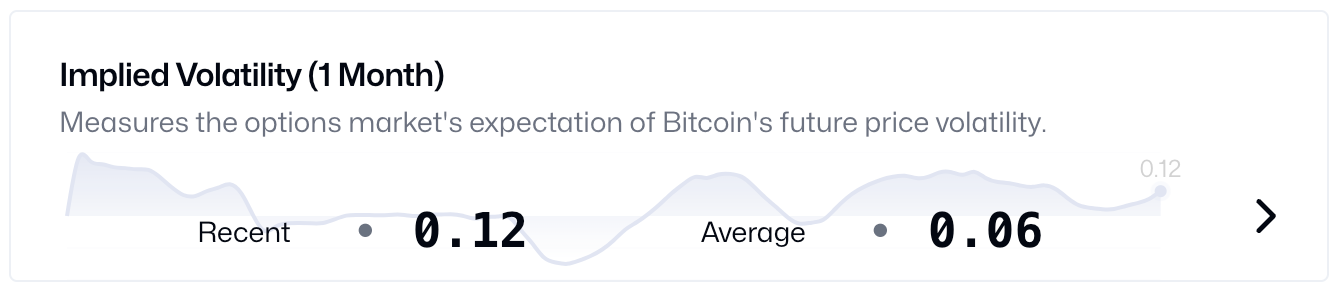

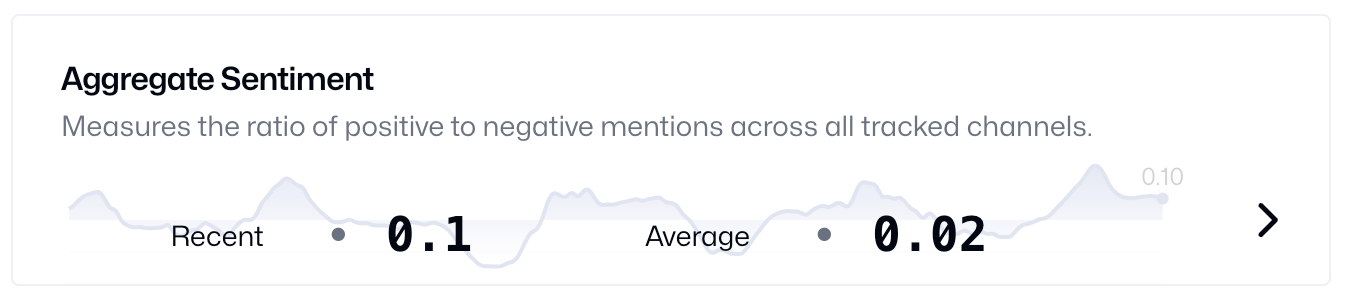

Volatility (25 %), Market Momentum/Volume (25%), Social Media (15%), Dominance (10%), (Google) Trends (10%), Surveys (15%) currently paused

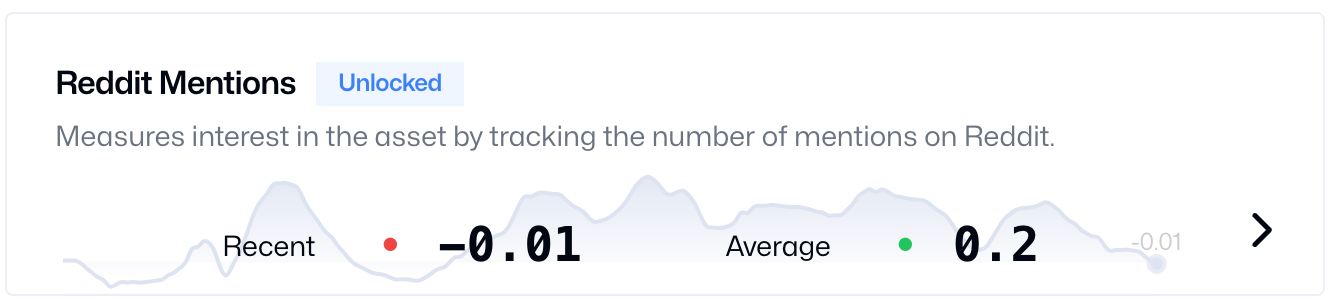

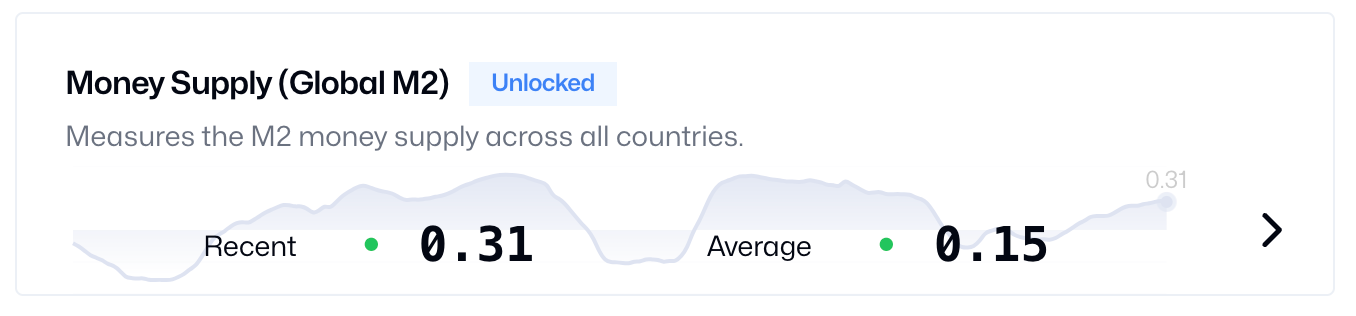

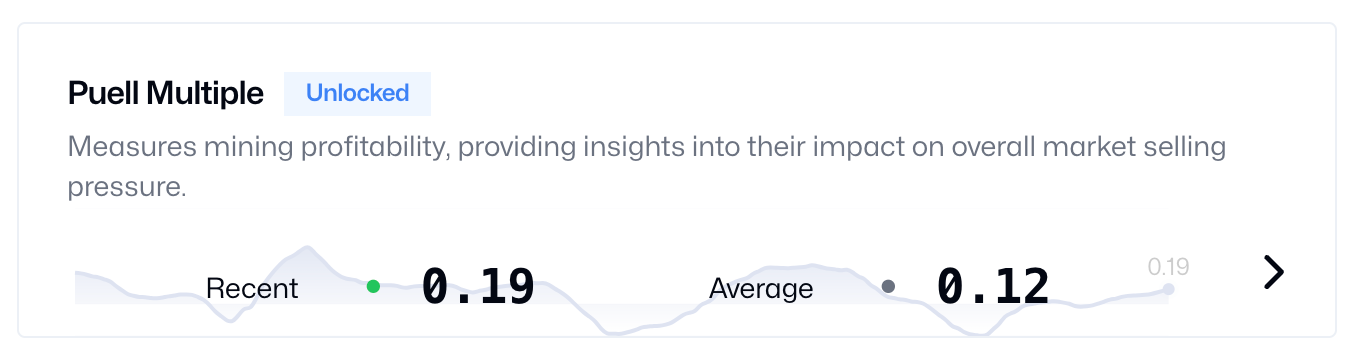

Do any of these work on their own? Let’s do a quick survey. We can look at the rolling correlation with 30 Day BTC forward returns to determine their predictive power.

So the answer is: yes, some of these have been pretty predictive in the past!

The Catch

But are they predictive in the direction that people expect it on social media? Does “Extreme Fear” indicate you should be leveraging up? Is it the perfect contrarian indicator?

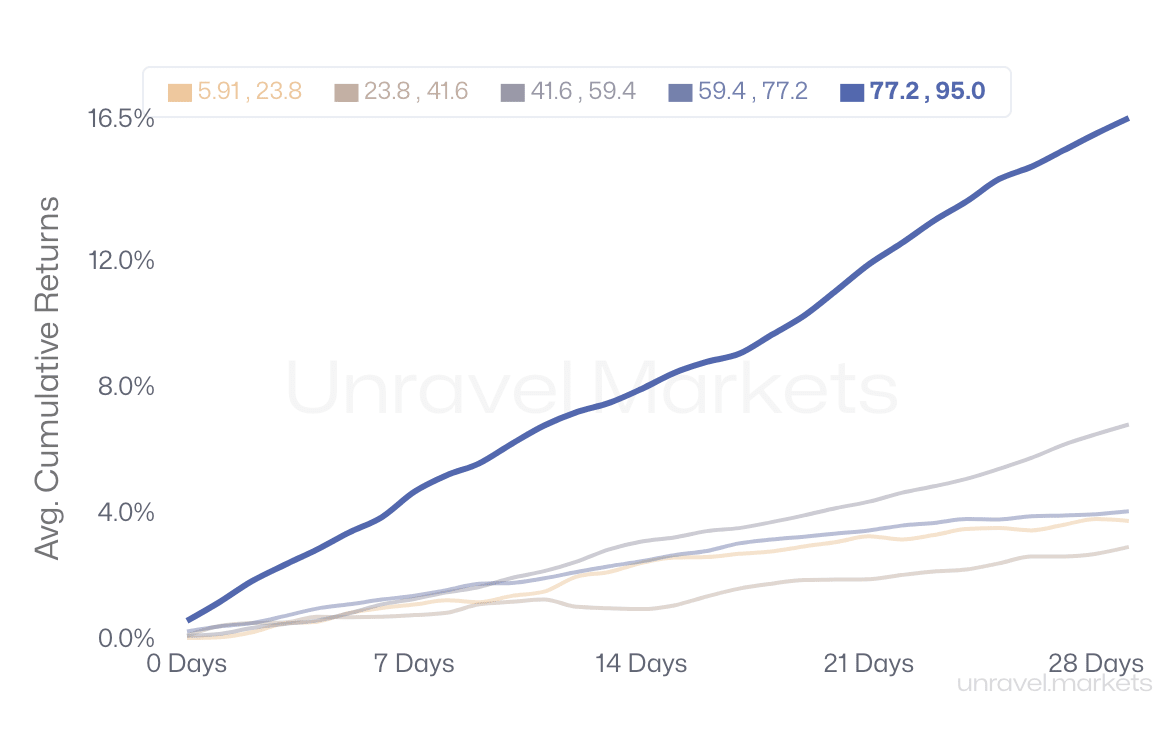

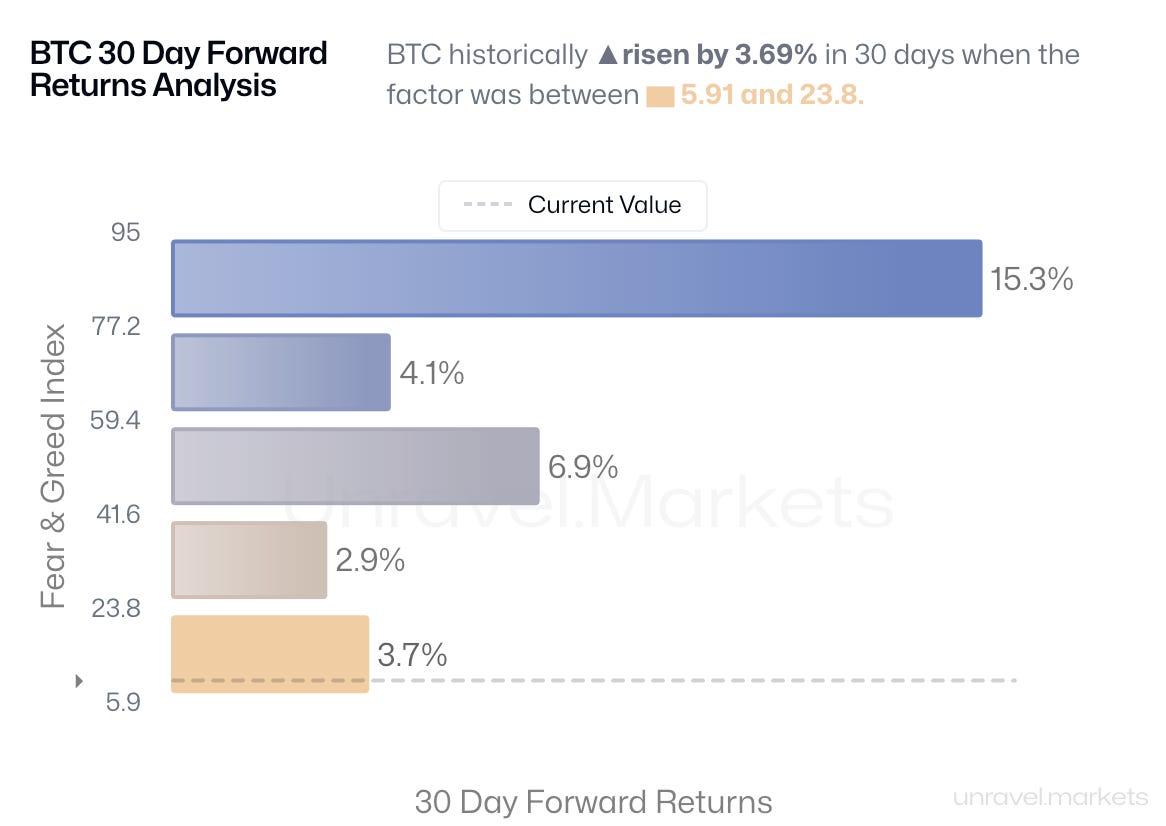

I’m afraid that’s not the case - historically, BTC has substantially underperformed when the reading was “Extreme Fear”, or anything near it.

The best time to hold Bitcoin was actually at the “Extreme Greed” rating - but overall the “Fear & Greed Index” is not a particularly great leading indicator.

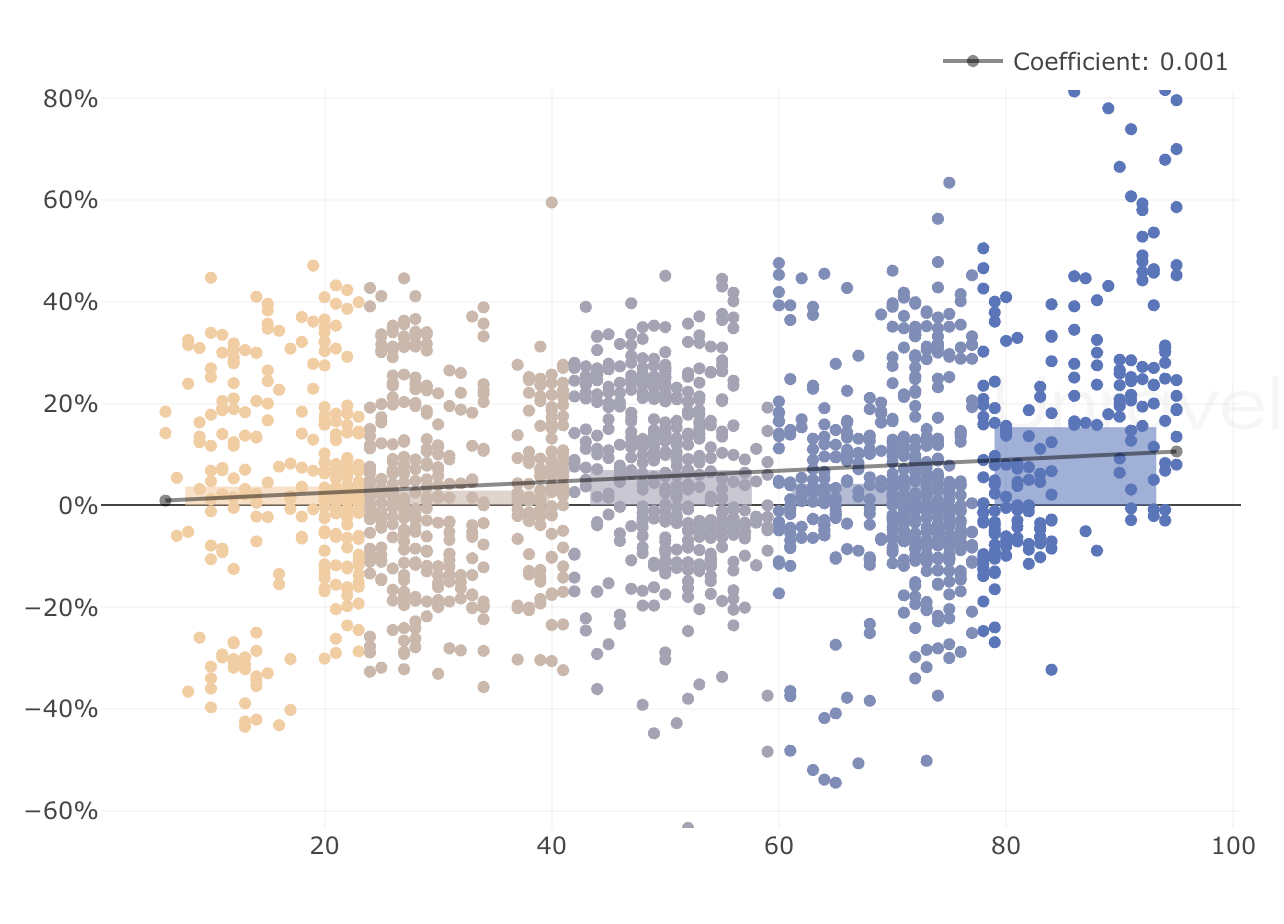

It would be if the relationship was linear — so higher index value would mean higher BTC returns, or vica versa. That’s not really the case, as you can see below.

If you’re interested, there are better predictive factors we written about below.

What about farther out, like 90 days?