How Speculative Money Flows into Crypto

Measuring how exogenous risk factors predict crypto returns

Compared to traditional futures or equities, crypto markets offer greater transparency—thanks primarily to the public blockchain and also to the unique culture that shaped the industry. This opens up new opportunities for investors and traders to monitor and measure liquidity dynamics that are otherwise hidden in conventional markets.

We’ve outlined a base framework to systematically identify and measure the drivers of crypto liquidity—beginning with external macro factors and progressively focusing inward on ecosystem-specific effects. With an emphasis on the qualitative aspects of these factors — specifically, measuring and reporting on their predictive power.

1. Outside the ecosystem: Global / Macro Factors

These are usually slow moving factors — the kind that talking heads on CNBC would be talking about, if they were talking about crypto:

Speculative Flow - The overall liquidity that’s moving towards more speculative, risky assets, like: tech stocks, emerging markets, high yield bonds.

These has been the quantitatively most consistently predictive factors over the last 5 years. Technically, they should be called “Momentum Spillover” effects - the momentum of other asset classes heavily affect the crypto market, creating predictable patterns that can be effectively used to manage risk.

For example, the momentum of cloud computing stocks has been leading the overall crypto market’s returns.

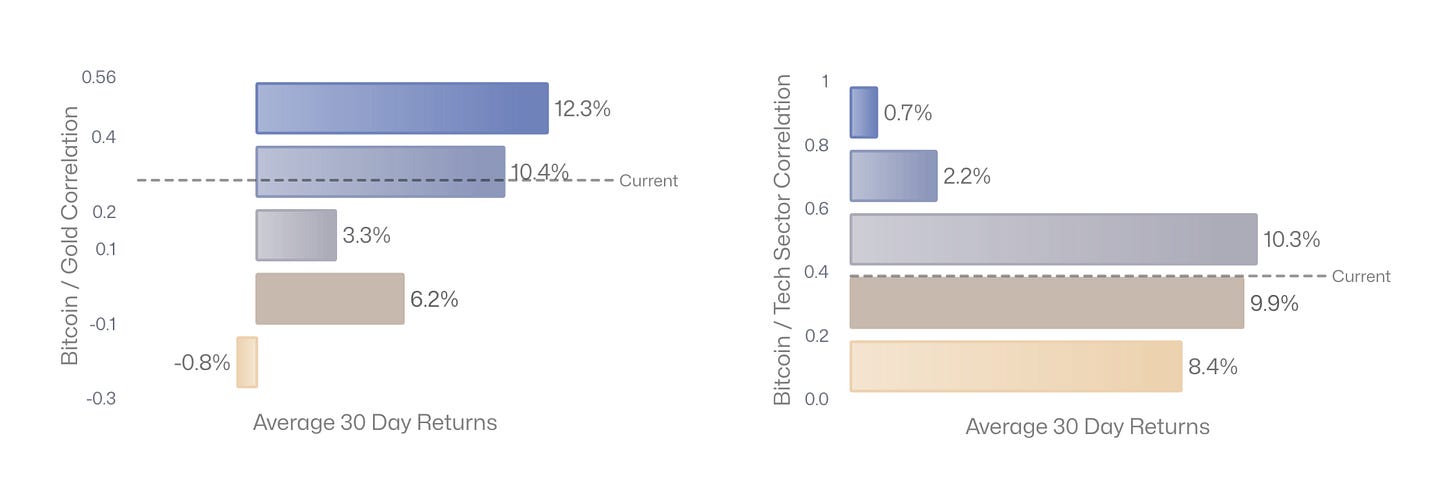

Safe heaven perception - When the current perception of Bitcoin is closer to Gold than a speculative asset, it’ll behave differently during times of stress and “risk-off” events. We could quantify this relationship by measuring the rolling correlation coefficient between Bitcoin and Gold’s returns, with the following results:

We see that the higher Bitcoin’s correlation was with gold, the higher its forward returns are. And, that the opposite this is true when measuring Bitcoin’s correlation with tech equities.

2. Closer to the Ecosystem: Money entering the sidelines

Stablecoin Market Cap (Indirect) - Tether and other stablecoin providers report their tokens in circulation. But as of lately, there’s increased adoption in stablecoins to settle native currency transactions - and not all of it is going to crypto. There are more fine-grained measures of that may be more reliable, see below.

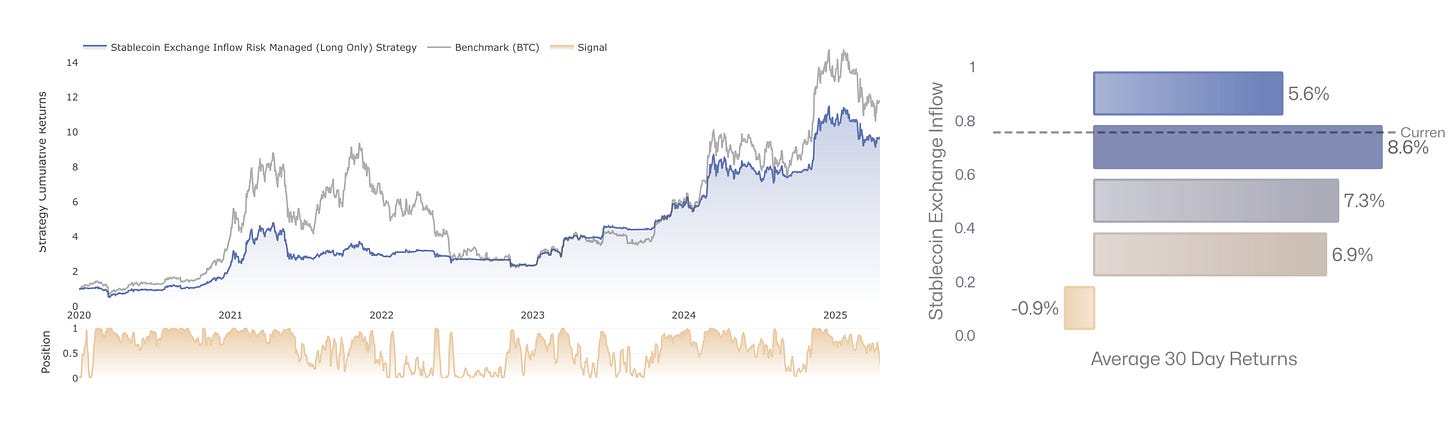

Stablecoin Exchange Inflow & Netflow (More direct) - Exchanges publish their wallet addresses for transparency reasons — we track the largest 40 exchanges stablecoin in & outflows, which enables a closer look at what’s happening within the stablecoin ecosystem.

The rationale is: there are very few reasons to park stablecoins on exchanges other than considering buying something with them.

ETF Netflow (Direct) - The spot Bitcoin ETF was launched in January 2024, had quite a good run since then, and it’s commonly understood as a proxy for institutional interest. There’s transparency here as well, providers publish the amount that entities holds, daily. Thanks to market makers, the ETFs are are - during normal circumstances - keep their NAV closely aligned with their market price, and that money flows into crypto effectively immediately through them — making this more of a direct channel for money to enter the crypto markets.

And evaluating its predictive power is tricky, as there’s only a bit more than a year of history available - which also coincided with a major bull run, making it very hard to judge whether it represents skill, we’ll dig into it in a later article.

3. Inside the Ecosystem: Leverage

Leverage is an effective indication of crypto system-wide risk, as it’s increasing the likelihood of sudden de-leveraging effects & large amount of forced liquidations.

This is exacerbated by the lack of circuit-breakers — a safety net that equity markets usually possess — and the result is usually a 10-20% wipeout of the whole ecosystem’s market cap within an hour.

Estimating leverage in the ecosystem can be done with various metrics, including:

Funding rates of perpetual futures - the “carry” that traders need to pay in order to maintain their position on (leveraged) futures contracts. The higher, the more people are willing to pay a premium to stay long. The only reason for that is to maintain leverage, making it a good candidate for a leverage proxy metric.

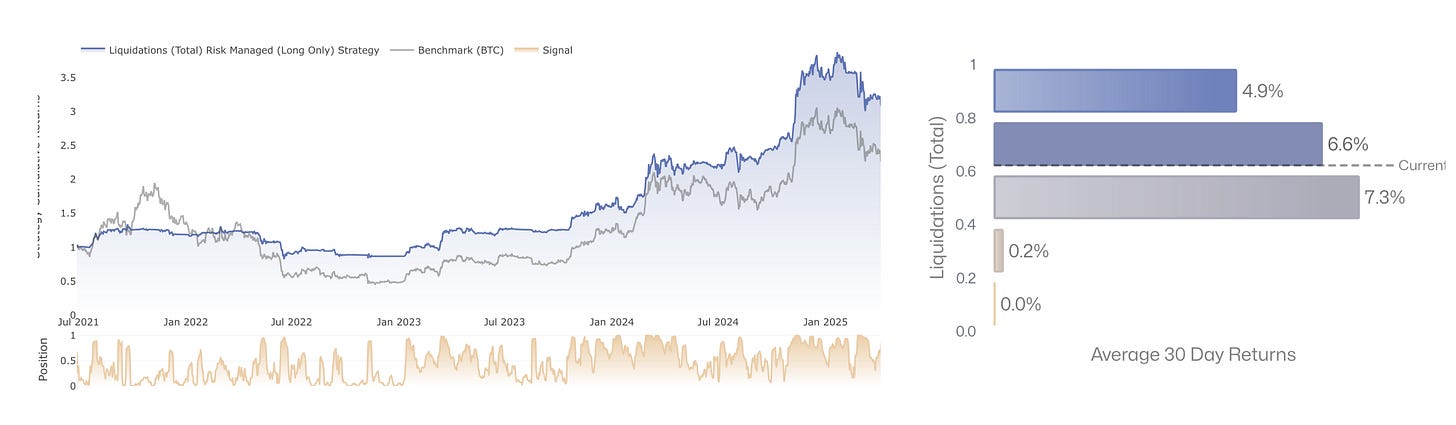

Liquidations - a large round of liquidations (caused by large moves) usually means leverage is flushed out of the system: you can only get liquidated by being over-leveraged.

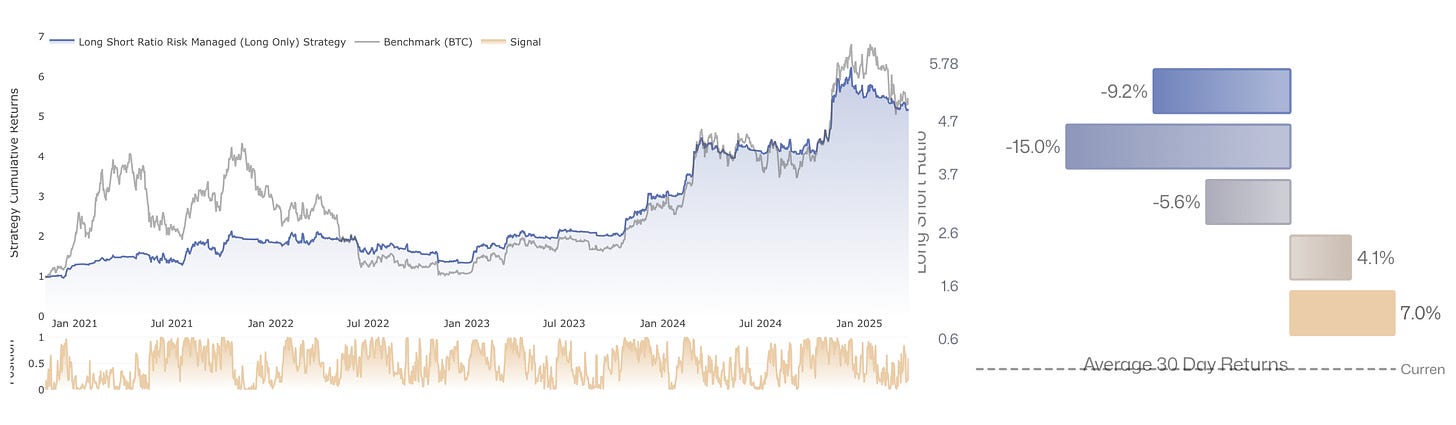

Long / short ratio - the volume of long positions, divided by the shorts. At the extremes, it can highlight the fact that the vast majority of the participants are already “very long” and the market can’t be really stretched further.

Margin borrow rates - traders usually borrow stablecoins to long other assets. The higher this rate is, the more people are borrowing, making it a relevant proxy metric.

We’ll explore these factors in an upcoming article, keep tuned!

Aside from the ecosystem-wide factors, there are also asset-specific ones, mainly along the lines of: public perception (trends/ fads), fundamentals (usefulness), and sentiment & momentum, which are usually difficult to disentangle.

How to use these factors?

The best framing for these factors is: they’re risk proxies, covering valuable, otherwise ignored aspects of the market, and can be used effectively to size directional exposure.

Traditionally, if you wanted to manage your portfolio’s risk with quantitative methods, you’d be relying on recent volatility to cut size when markets are volatile. But, it works less well in crypto — we’ll cover this later. It’s not that it doesn’t work because many market participants are already using this technique, more that the large amount of leverage and the sudden liquidity shocks mimic market-wide volatility-based risk management and erode its usefulness.

What would an effective risk management layer look like, that also includes exogenous risk factors?

When less-to-no money is flowing into the crypto ecosystem, reduce directional exposure. Especially when the metrics indicate that money is about to start flowing out of crypto, like people moving their crypto assets to exchanges.

When ecosystem-wide leverage is the highest, the risk of an even smaller shock creating an cascading sell-off is higher. Proactively reducing exposure during prolonged over-leveraged periods is beneficial - before an inevitable, sudden de-leveraging event happens. By that time, it’s already too late: liquidity dries up and there’s no effective way to hedge anymore.

These risk factors work even better when applied on the more speculative assets, starting from Ethereum and going down in market cap — because their returns are more purely driven by speculative money flow & leverage.

We realized the value of broadening risk metrics beyond traditional measures by incorporating money flow and liquidity indicators— with Unravel, we’re working on making this research accessible and easy to apply.

Especially for risk management is needed the most: for the most volatile assets.